illinois taxes due date 2021

The 2021 pay 2022 Real Estate taxes-Will be in the mail May 25th 2022. 090522 LABOR DAY - OFFICE CLOSED.

Tax Season 2021 These States Updated Their Tax Deadlines

090222 Per Illinois State Statute 1½ interest per month due on late payments.

. Technical problems and internal. June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment. Beginning May 2 2022.

The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday. 1 with a due date of Dec. The due dates are.

Q2 Apr - Jun July 20. The Illinois 2021 tax filing deadline has been extended until May 17 matching the IRS federal tax filing extension announced Wednesday. 1st installment due date.

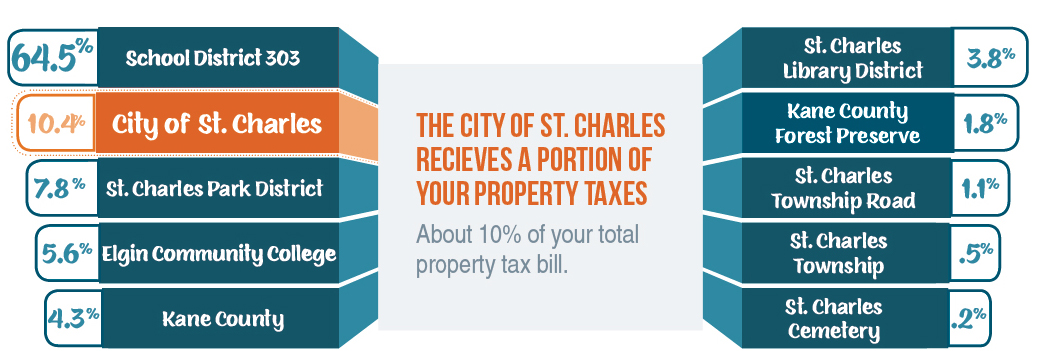

Illinois was home to the nations second-highest property taxes in 2021. The mailing of the bills is dependent on the completion of data by other local. 2021 Real Estate Tax Calendar payable in 2022 May 2nd.

IRS will delay tax filing due. 15 penalty interest added per State Statute. 111722 Property Tax Sale.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. Now rampant inflation is giving local taxing bodies the power to raise rates by 5. Administration of refunds resulting from duplicate payments of the same taxes overpayments of taxes due or reductions in assessments after original billing as.

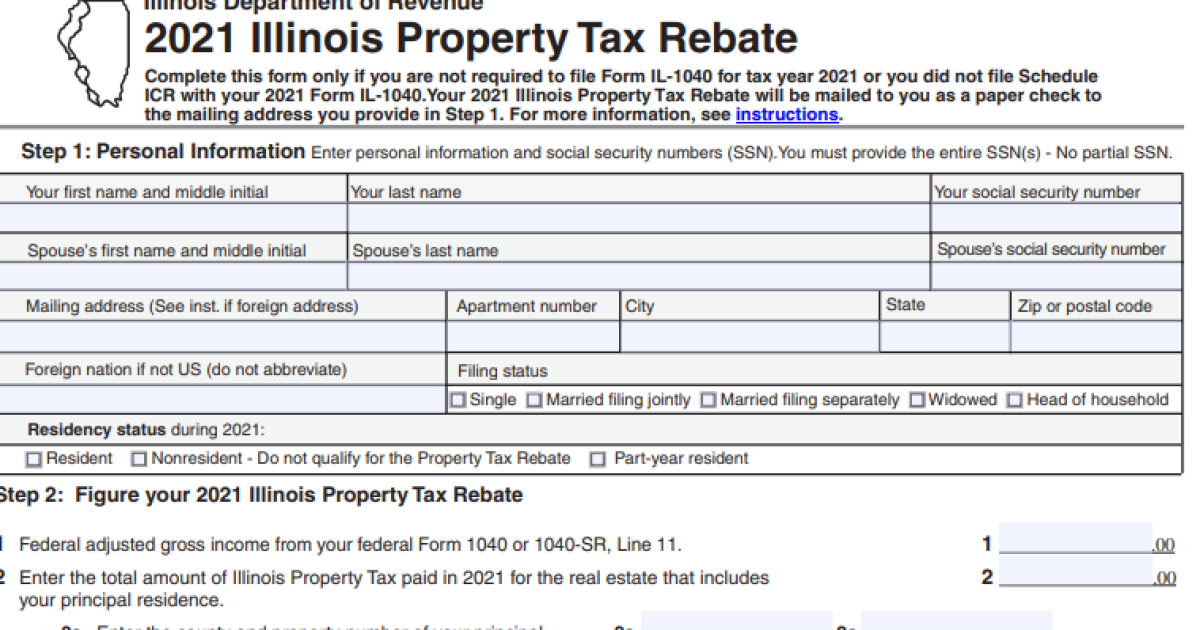

Illinois Department of Revenue Announces Extended Income Tax Filing Due Date for Corporations. Illinois Extends Income Tax Filing Deadline Pritzker Announces The extension does not apply to estimated tax payments due on April 15 2021 according to Pritzkers office. Property tax bills mailed.

The Illinois Department of Revenue on October 11 released Bulletin FY 2023-02 Corporate Return Automatic Extension Due Date Change for the Tax Year Ending on December. Illinois Department of Revenue Director David. Q1 Jan - Mar April 20.

FY 2023-02 Corporate Return Automatic Extension Due. We grant an automatic six-month extension of. County Farm Road Wheaton IL 60187.

Has yet to be determined. The state income tax extension does not apply to estimated tax payments that are due April 15 the traditional tax filing deadline. 090122 2nd installment due date.

Tax Year 2021 Second Installment Property Tax Due Date. The second installment of the 2021 Cook County property taxes is expected to be delivered by Dec.

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Illinois Tax Forms 2021 Printable State Il 1040 Form And Il 1040 Instructions

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

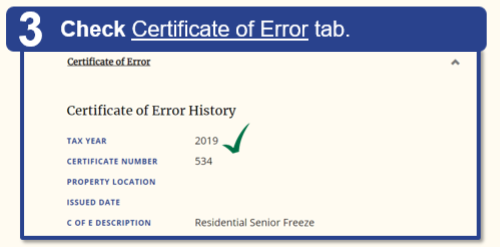

2022 Property Tax Bill Assistance Cook County Assessor S Office

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

2022 Property Tax Bill Assistance Cook County Assessor S Office

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Withholding Income Tax Return Due Date Filing Reminder

Illinois Extends Income Tax Filing Deadline Pritzker Announces Nbc Chicago

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Latest Impacts To 2021 Tax Season Filing Dates Wolters Kluwer

Current Payment Status Lake County Il

Illinois 2021 Tax Deadline Extended To Match Irs Federal Extension Abc7 Chicago

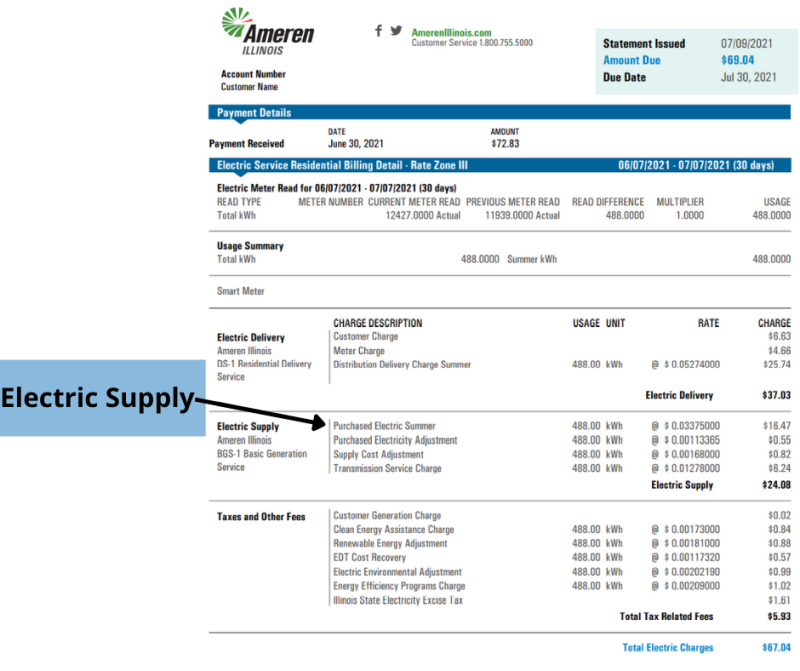

Q A Electricity Price Spike In Central And Southern Illinois Citizens Utility Board

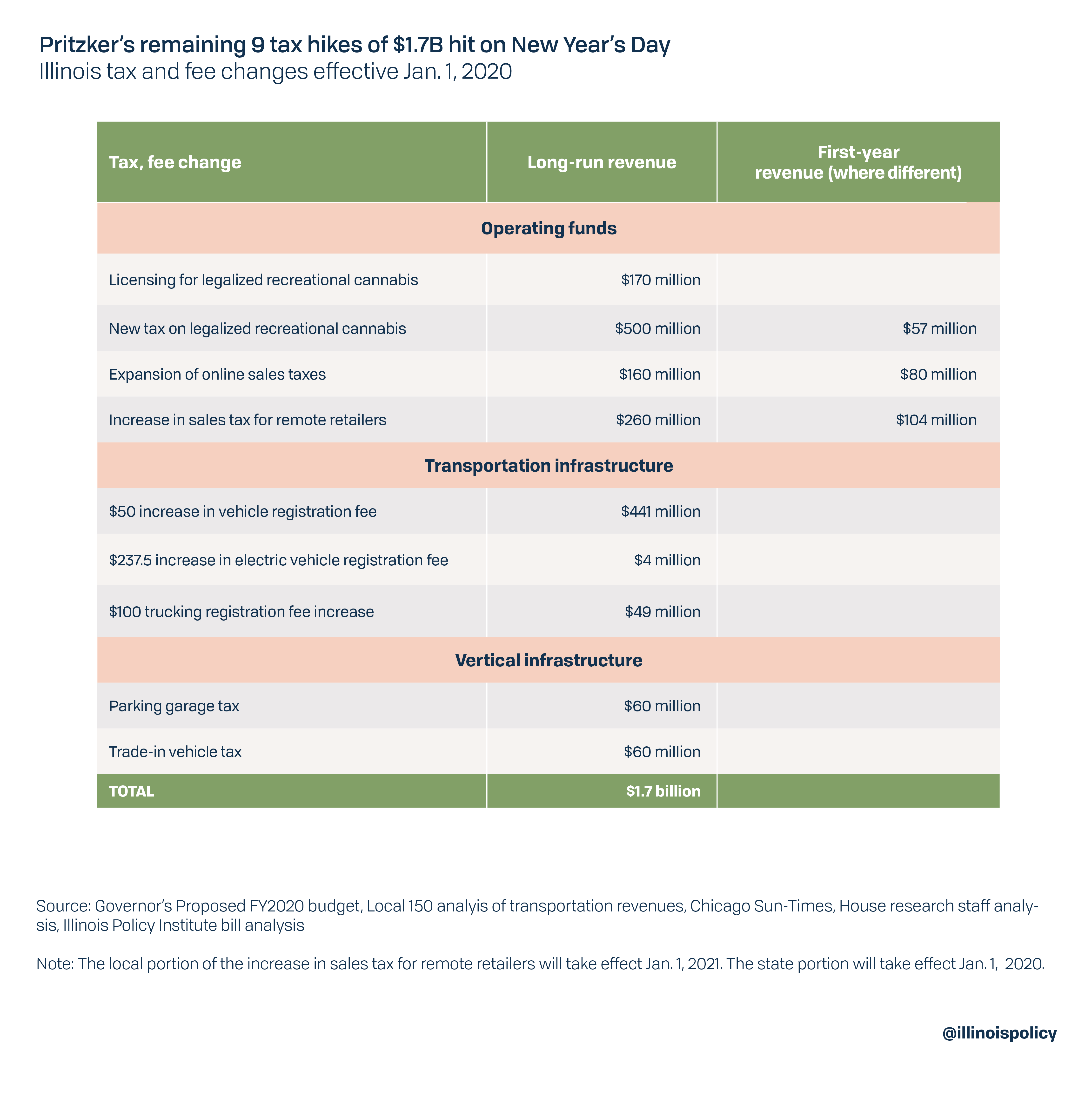

9 New Illinois Taxes Totaling 1 7b Take Effect Jan 1

Estimated Effective Property Tax Rates 2009 2018 Selected Municipalities In Northeastern Illinois The Civic Federation