knoxville tn sales tax rate 2020

Please click on the links to the left for more information. Sales tax rates in Knox County are determined by seven different tax jurisdictions Grainger Anderson Plainview Knox Alcoa Farragut and Knoxville.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

212 per 100 assessed value.

. There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614. The Tennessee state sales tax rate is currently. Download all Tennessee sales tax rates by zip code.

Sales or Use Tax Tenn. This is the total of state county and city sales tax rates. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275.

The Knoxville sales tax rate is 0. On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually. The general state tax rate is 7.

The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County. What is the sales tax rate in Knox County. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

The current total local sales tax rate in Knoxville. 925 7 state 225 local City Property Tax Rate. 4512 McCloud Springs Ln Knoxville TN 37938-3286 is a single-family home listed for-sale at 489900.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Monday - Friday 800 am - 430 pm Department Email. The minimum combined 2022 sales tax rate for Knoxville Maryland is 6.

05 lower than the maximum sales tax in TN. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. Did South Dakota v.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Tennessee has recent rate changes Fri Jan 01 2021. With local taxes the total sales tax rate is between 8500 and 9750.

31 rows The state sales tax rate in Tennessee is 7000. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated. The local tax rate varies by county andor city.

The County sales tax rate is. SOLD MAR 17 2022. The 2018 United States Supreme Court decision in South Dakota v.

Tennessee has 779 special sales tax jurisdictions with local. This is the total of state county and city sales tax rates. Knox County TN Sales Tax Rate The current total local sales tax rate in Knox County TN.

24638 per 100 assessed value. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments.

The minimum combined 2022 sales tax rate for Knox County Tennessee is. You can print a 925 sales tax table here. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275.

The County sales tax rate is. The Knoxville sales tax rate is. There is no applicable city tax or special tax.

2022 Tennessee state sales tax. Current Sales Tax Rate. Other local-level tax rates in the state of Tennessee are.

This is the total of state county and city sales tax rates. Average Sales Tax With Local. The Knoxville sales tax rate is.

Knox County Tennessee has a maximum sales tax rate of 975 and an approximate population of 337101. The Maryland sales tax rate is currently 6. The Alabama sales tax rate is currently.

The minimum combined 2022 sales tax rate for Knoxville Alabama is. This is the total of state and county sales tax rates. The Knox County sales tax rate is.

Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250. The County sales tax rate is 0. What is the sales tax rate in Knoxville Maryland.

The sales tax is comprised of two parts a state portion and a local portion. This tax is generally applied to the retail sales of any business organization or person engaged. State Local Sales Tax Rates As of January 1 2020.

Knoxville is located within Knox County Tennessee. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. City of Knoxville Revenue Office.

Exact tax amount may vary for different items. Knoxville PA Sales Tax Rate. Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250.

County Property Tax Rate. County Property Tax Rate. Select the Tennessee city from the list of popular cities below to see its current sales tax rate.

Food in Tennesse is taxed at 5000 plus any local taxes. The Tennessee sales tax rate is currently. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax.

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Indiana Sales Tax Rates By County

Vape E Cig Tax By State For 2022 Current Rates In Your State

Tennessee Car Sales Tax Everything You Need To Know

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Traditional Finances City Of Conroe

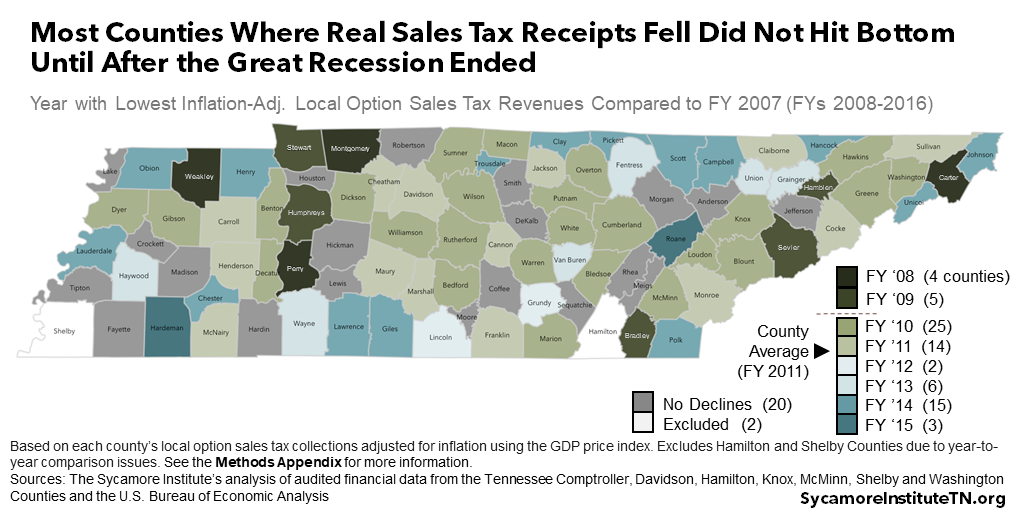

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Traditional Finances City Of Conroe

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Illinois Sales Tax Rates By City County 2022

Tennessee Sales Tax Rates By City County 2022

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

Vape E Cig Tax By State For 2022 Current Rates In Your State

Traditional Finances City Of Conroe

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram